A Handbook On Base Erosion And Profit Shifting-Addressing Global Tax Avoidance : C.A. Akshay Kenkre: Amazon.in: Books

Base Erosion and Profit Shifting ((BEPS) | Deloitte | Tax Services | International Tax |Insights | Article

Addressing Base Erosion And Profit Shifting: Organization for Economic Cooperation and Development: 9789264192652: Amazon.com: Books

Buy Addressing base erosion and profit shifting Book Online at Low Prices in India | Addressing base erosion and profit shifting Reviews & Ratings - Amazon.in

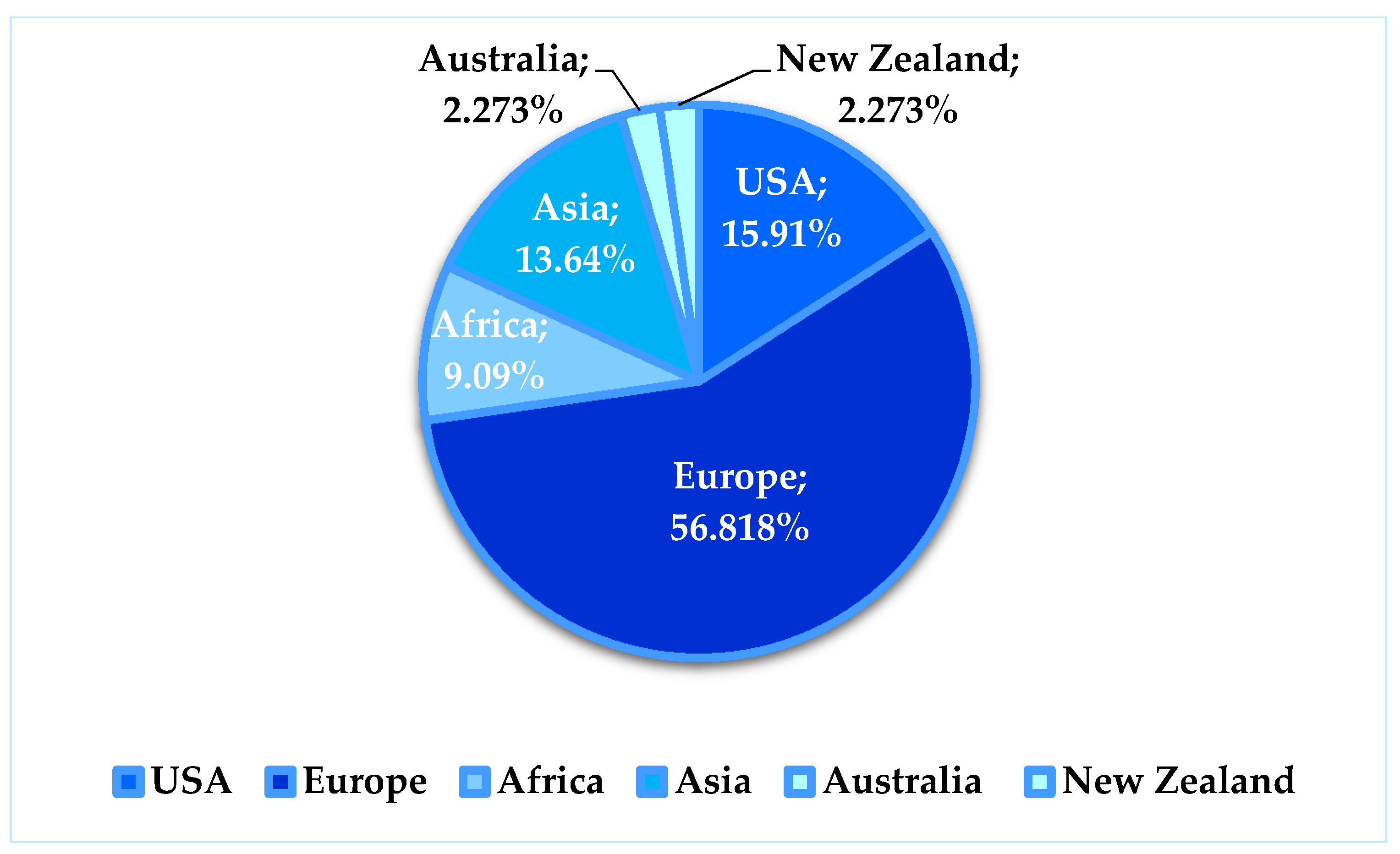

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

Addressing Tax BEPS in the Mining Industry in Developing Countries | Brochure (EN/FR/ES) - IGF Mining

Oecd/G20 Base Erosion and Profit Shifting Project Addressing the Tax Challenges of the Digital Economy, Action 1 - 2015 Final Report: Organisation For Economic Co-Operation And Development, Oecd: 9789264241022: Amazon.com: Books

Oecd/G20 Base Erosion and Profit Shifting Project Addressing the Tax Challenges of the Digital Economy in Kuwait | Whizz Treaties

OECD/G20 Base Erosion and Profit Shifting Project Developing a Multilateral Instrument to Modify Bilateral Tax Treaties, Action 15 - 2015 Final Report (Paperback) - Walmart.com

PDF) Islamic Game Theory approach for overcoming base erosion profit shifting challenges for the Organization of Islamic Cooperation

Tax Base Erosion and Profit Shifting (BEPS) in Mining | International Institute for Sustainable Development