Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding Inside vs. Outside Basis - Certified Tax Coach

Basis Multifamily Finance Closes Three Freddie Mac Loans for Texas Affordable Housing Refis Totaling $27.8 Million | Real Estate Weekly

LLC Partnership Tax Basis & Basics: Form 1065, Sch K-1, Capital Account, Inside Basis, Outside Basis - YouTube

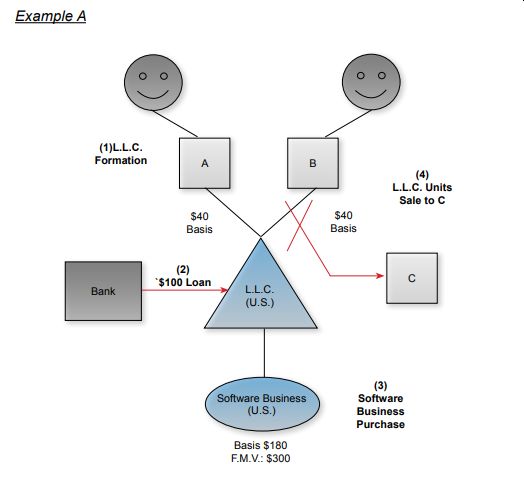

Tax 101: Tricky Issues When A Non-U.S. Person Invests In An L.L.C. Or Partnership Operating In The U.S. - Withholding Tax - United States

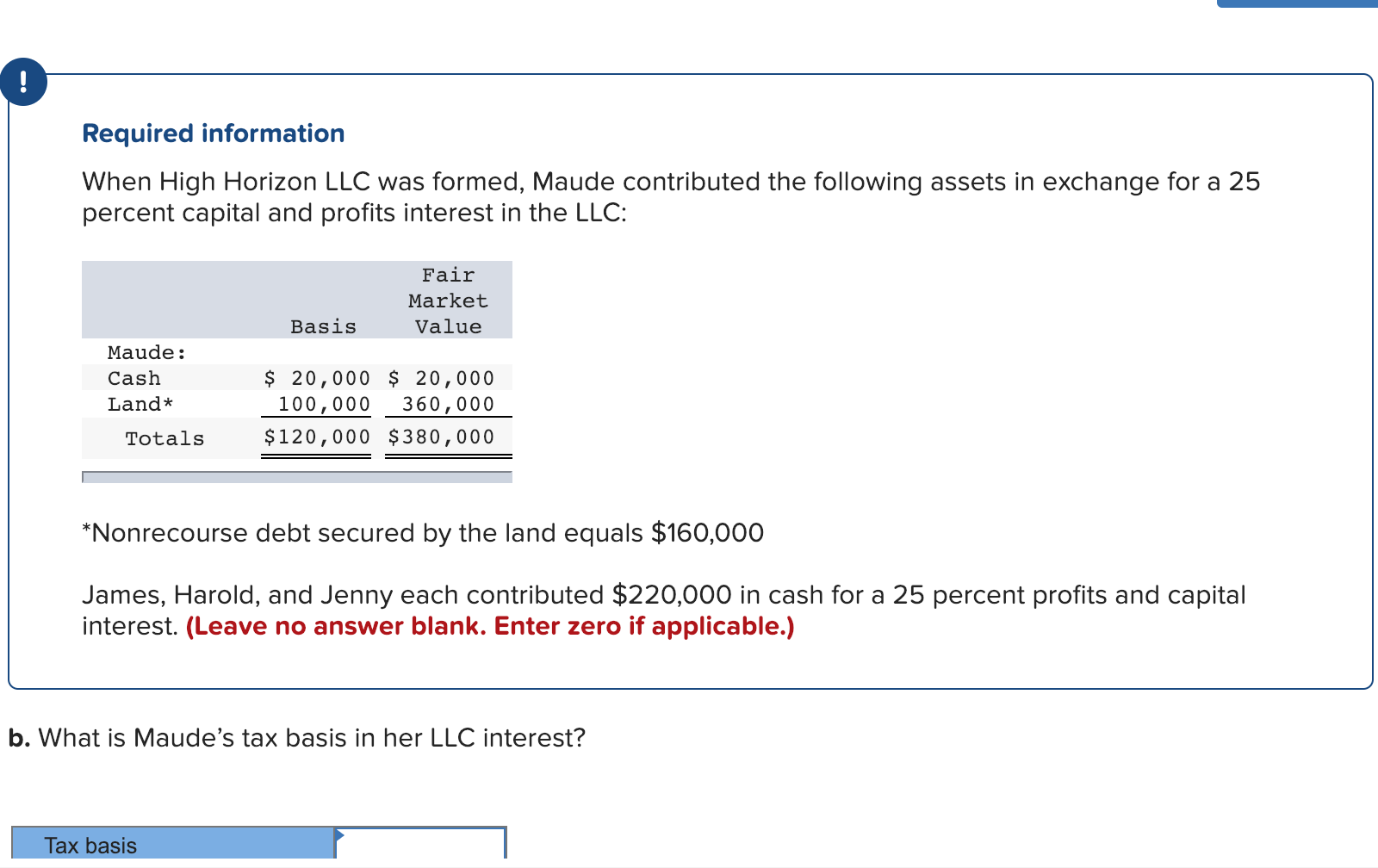

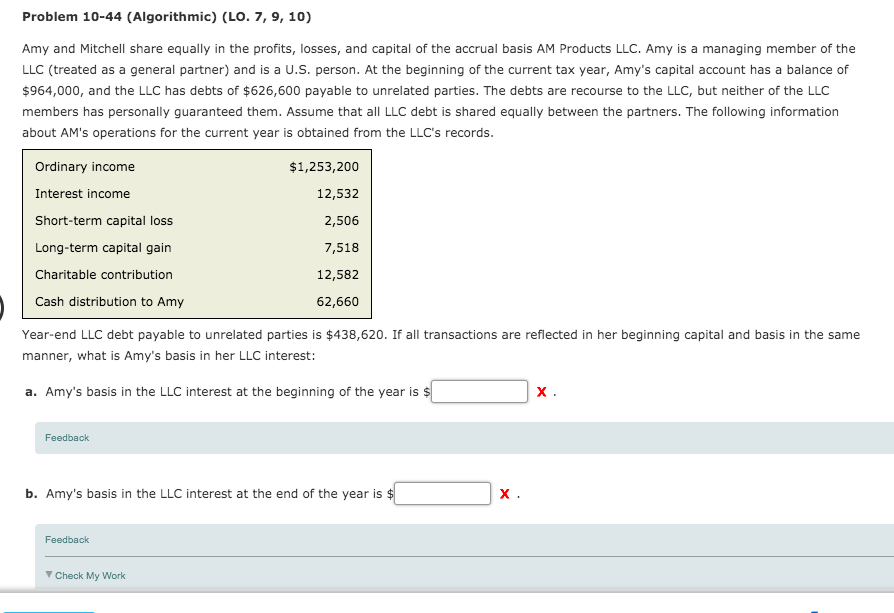

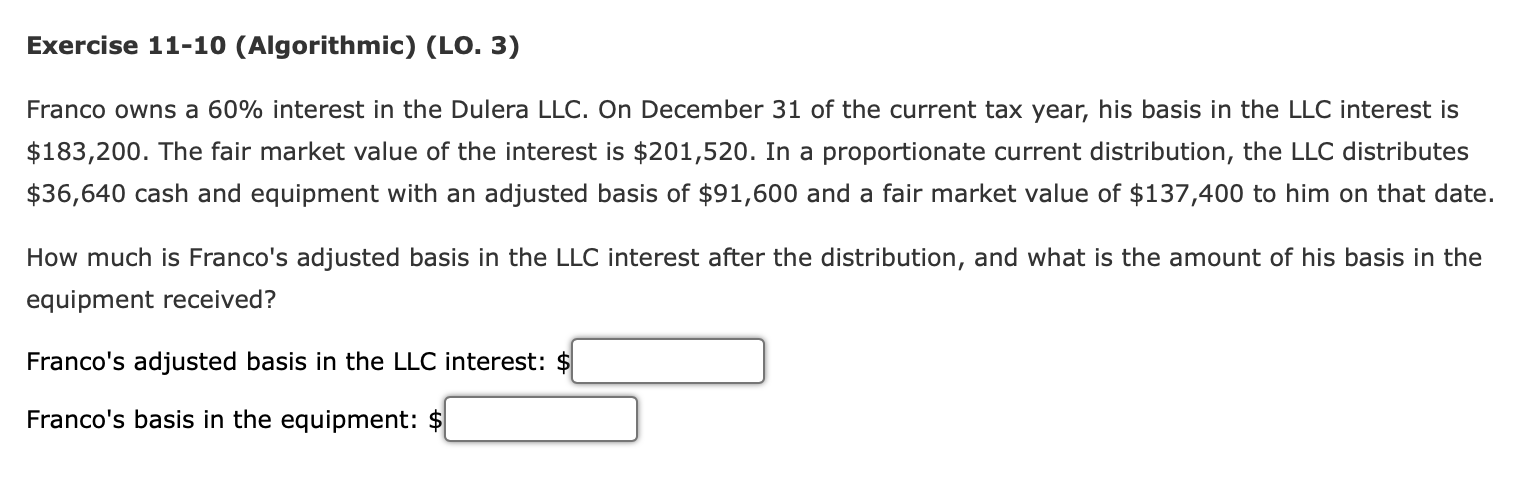

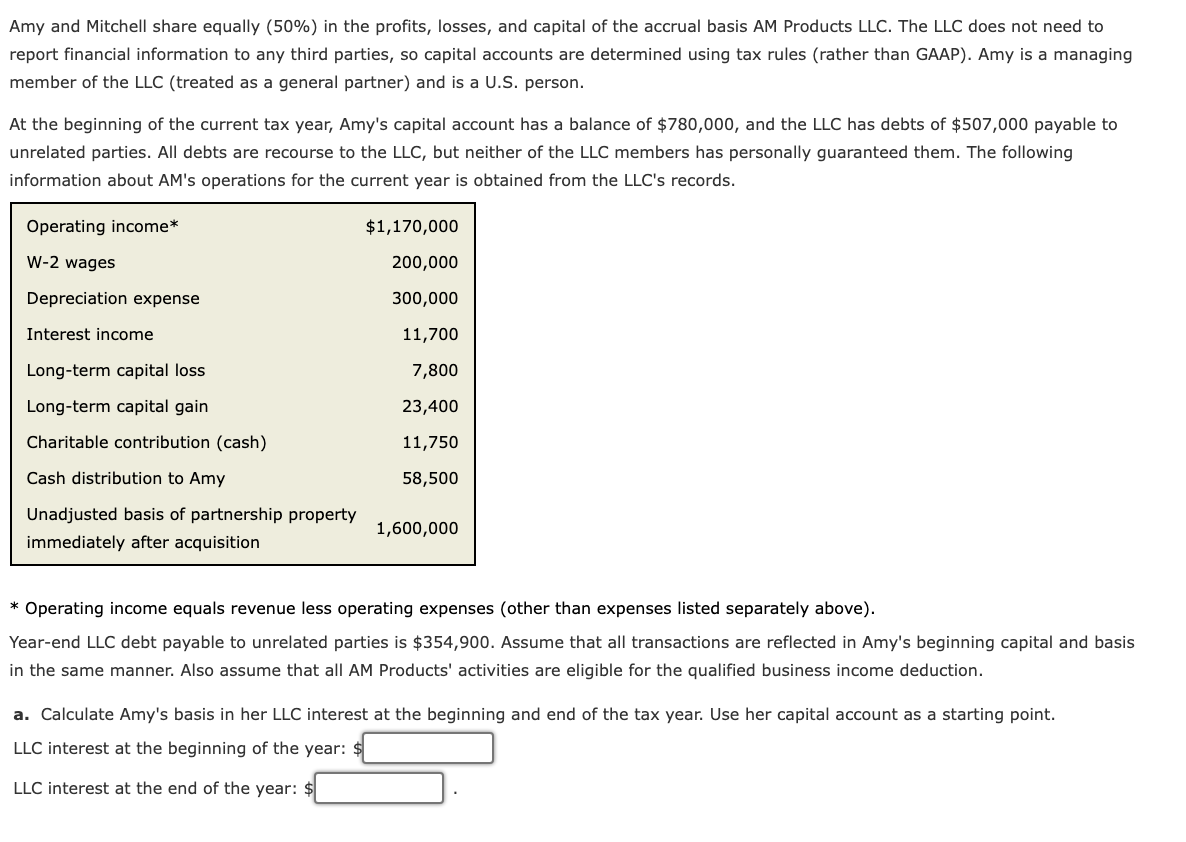

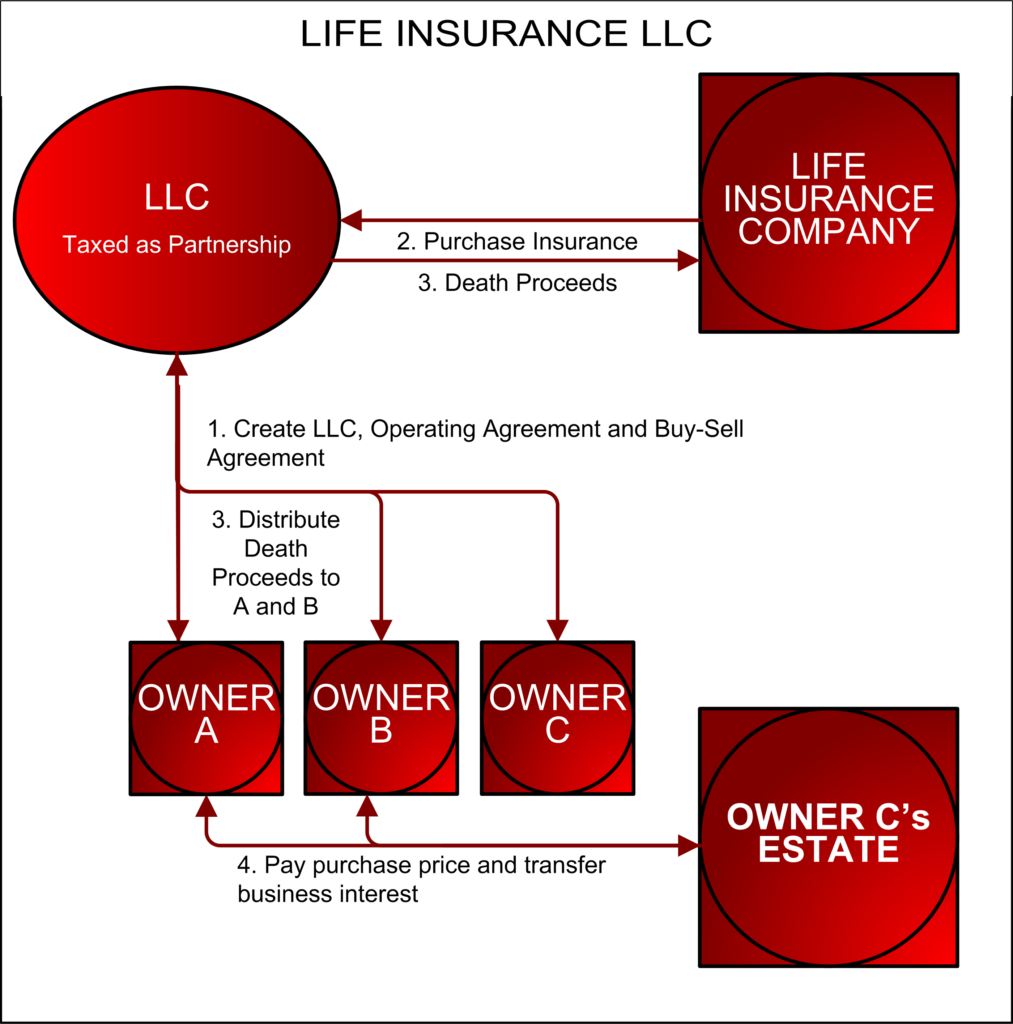

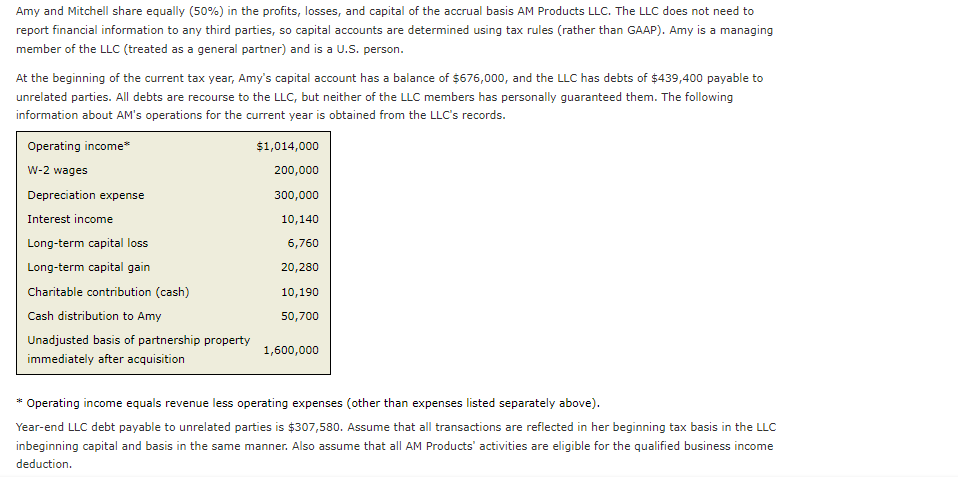

Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding Inside vs. Outside Basis - Certified Tax Coach