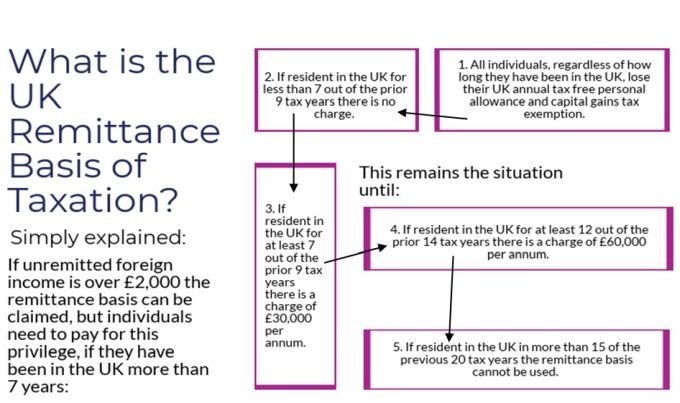

GMS Flash Alert 2015-105 Malta – Changes to Remittance Basis, Highly Qualified Persons Rules (September 9, 2015)

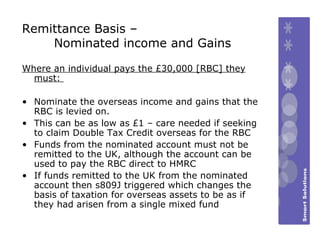

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

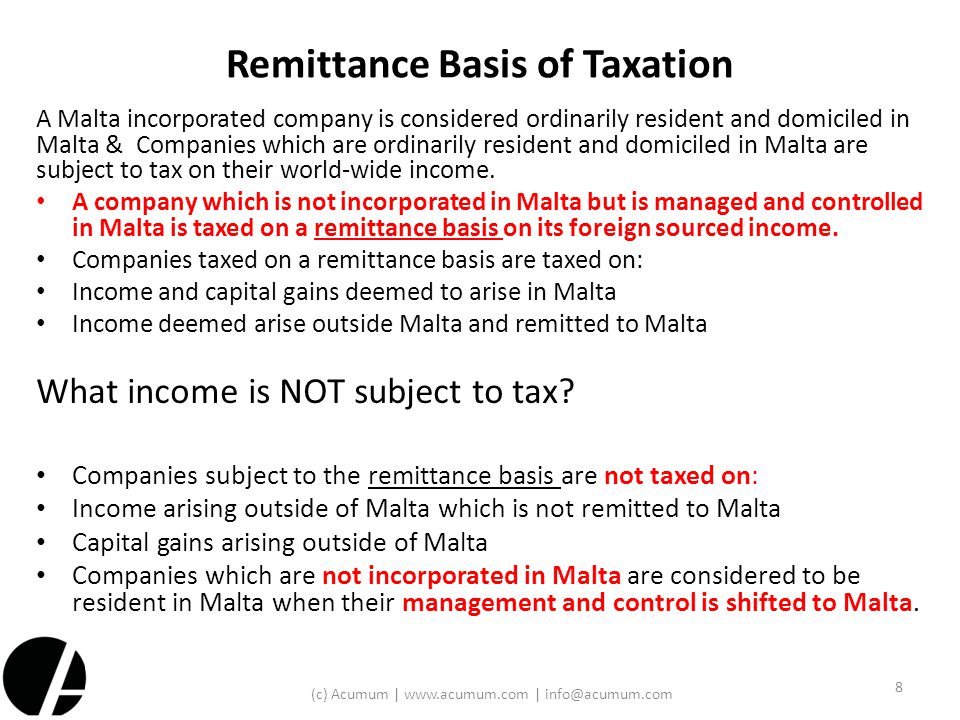

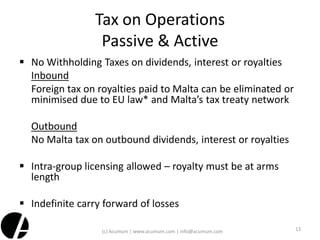

Fenech & Fenech Advocates - Malta operates a remittance basis of taxation for persons who are resident or domiciled in Malta for tax purposes. The Budget Implementation Act (Act VII of 2018),