Broadening the business tax base and aligning tax rates across sectors | OECD Tax Policy Reviews: Seychelles 2020 | OECD iLibrary

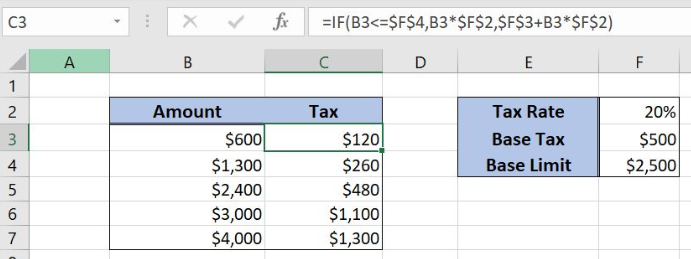

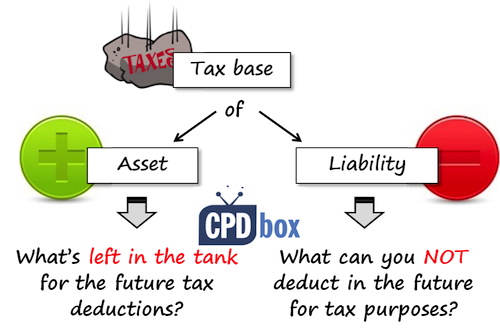

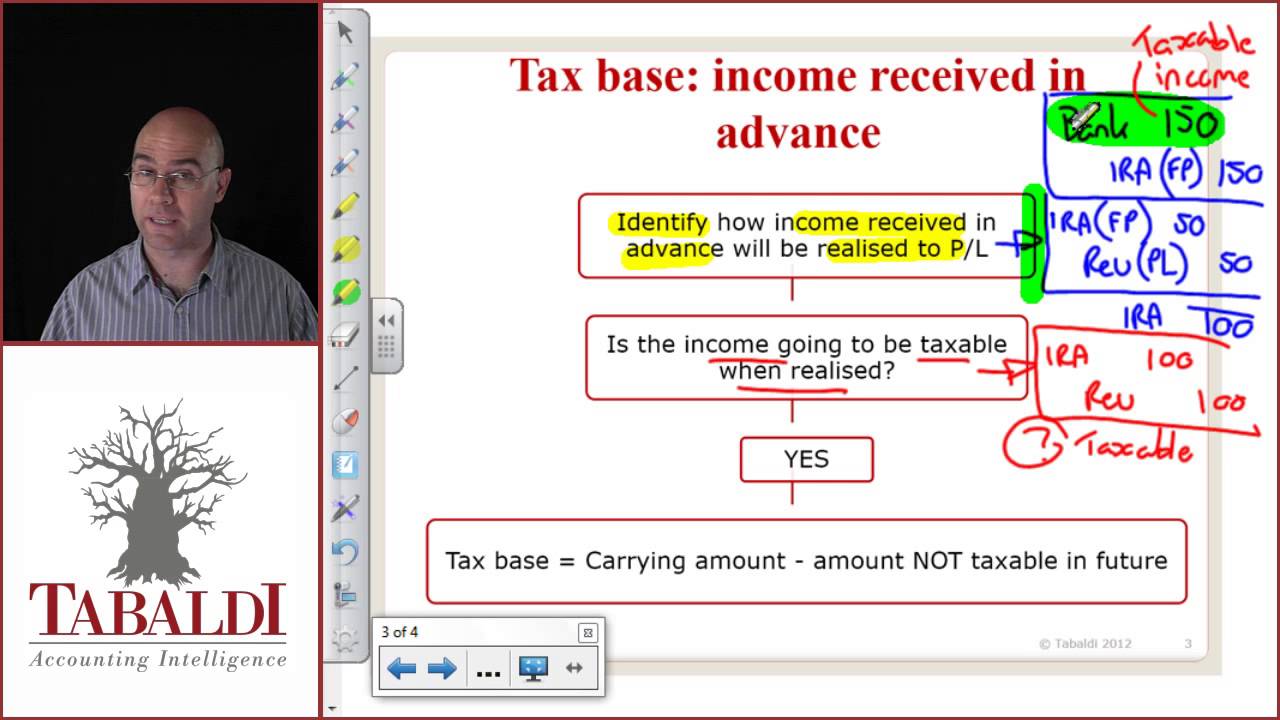

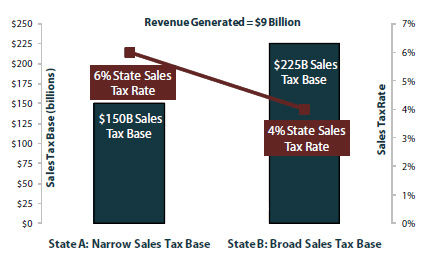

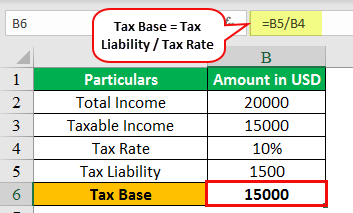

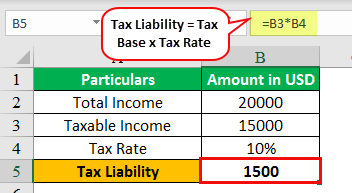

Chapter 14 Taxes Tax Bases and Structures Tax base is the income, property, good or service that is subject to a tax. Comes from individual income. - ppt download

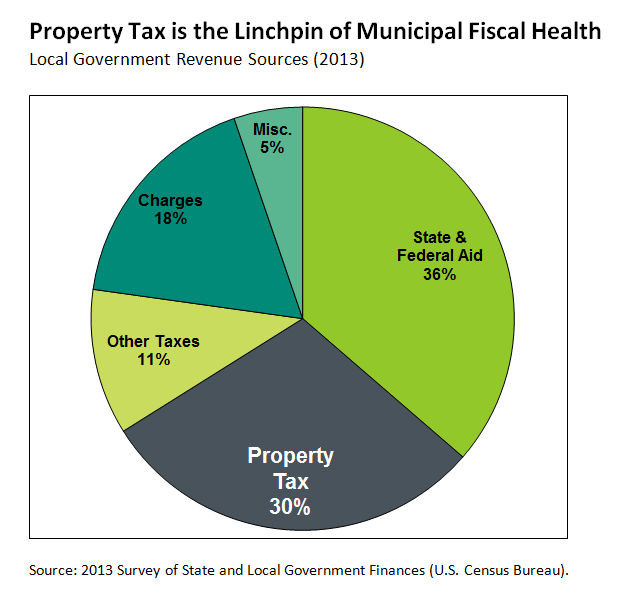

Chapter 14 Taxes and Government Spending. Section 1: What are Taxes? Tax: required payment to a local, state, or national government What is tax money. - ppt download

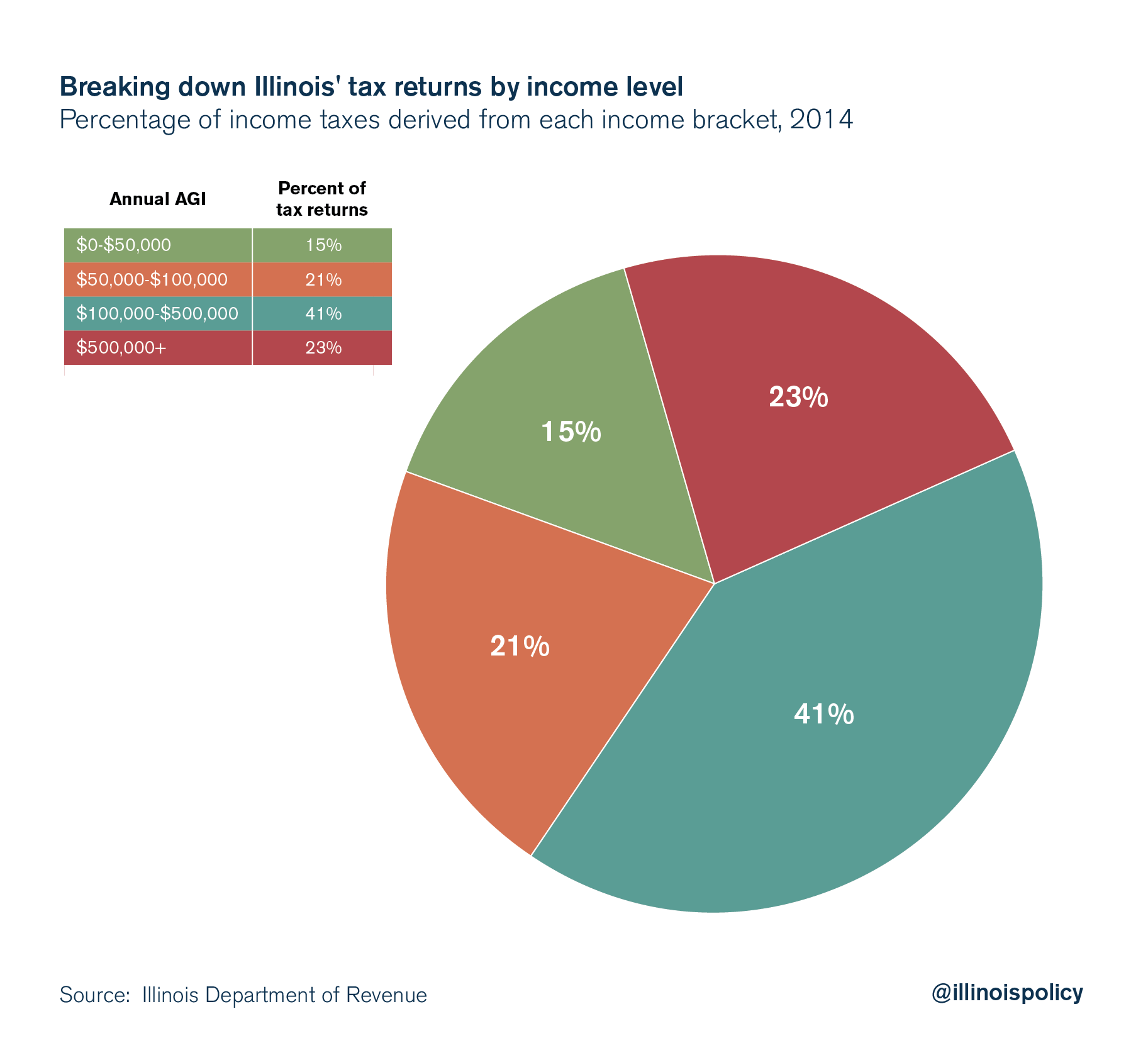

A broader tax base that closes loopholes would raise more money than plans by Ocasio-Cortez and Warren - The Boston Globe